Toto Finance (formerly Tiamonds) launches a model for tokenizing real-world assets on Cardano. Verified physical assets are linked to on-chain digital records, enabling clear and auditable ownership. The solution is already live and supports faster settlement and a regulated framework for RWA tokenization.

The Cardano project is known for its emphasis on a research-driven approach, and it was the first blockchain platform to evolve out of a scientific philosophy and a research-first driven approach.

The Cardano blockchain operates in a unique way. It uses a new proof of stake algorithm known as Ouroboros. Unlike proof-of-work blockchains, which rely on miners to verify transactions and create new blocks, the Ouroboros algorithm chooses a node (stakeholder) to generate a new block based on the proportion of cryptocurrency that stakeholder holds. This makes the Cardano network highly scalable.

Cardano’s ADA token is used for transactions within the network as well as a way for network participants to vote on changes to the platform. It is designed to ensure that owners can participate in the operation of the network. Because of this, those who hold the cryptocurrency have the right to vote on any proposed changes to the software.

One of the most distinguishing features of Cardano is its layered architecture including the Cardano Settlement Layer (CSL) and the Cardano Computation Layer (CCL). The CSL manages the cryptocurrency ADA, and handles transactions, while the CCL is responsible for the smart contracts and computation. This separation allows for better network security, flexibility, and simplicity in the design of smart contracts.

Toto Finance Debuts New Brand and Platform for Tokenization of Commodities and Real-World Assets

Toto Finance, formerly known as Tiamonds, today announced its transformation into a global platform for tokenized commodities, real-world assets, and digital trade infrastructure, marking a decisive expansion beyond diamonds toward the broader $30 trillion global commodities and trade markets.

As the pioneer of regulated real-world asset tokenization, Toto Finance is redefining how tangible assets — such as gold, copper, rare earth elements, oil, energy and in-ground reserves — are valued, verified, owned, traded, and financed. By merging institutional-grade compliance with blockchain efficiency, the company is building a trusted, transparent, and liquid environment for investors and institutions participating in the global commodities economy. Toto Finance is unlocking these markets through tokenization — creating transparent, borderless, and verifiable digital ownership for investors worldwide.

Through its Total Tokenization model, Toto Finance bridges traditional finance with Web3 infrastructure, enabling institutional-grade digital ownership and instant global settlement of physical assets. Investors gain the ability to trade, fractionalize, and transfer real-world value across jurisdictions with unprecedented speed, security, and transparency.

“We’re building the global infrastructure for Total Tokenization — powering the future of global trade, commodities, and real-world assets,” said Steven Gaertner, Director at Toto Finance. “By expanding beyond diamonds, we’re unlocking access to tokenized commodities, from gold and copper to in-ground oil reserves — creating new opportunities for investors and institutions worldwide.”

Founded in 2023 as Tiamonds, the company pioneered the world’s first tokenized diamond marketplace before evolving into Toto Finance — a global platform for commodities and real-world assets. With operations spanning the United States, Europe, and the MENA region, Toto Finance is structured as an enterprise with global market reach. Toto Finance’s rebrand marks a pivotal milestone in the evolution of digital wealth infrastructure, where trust, compliance, and innovation converge to reshape the global movement of assets, commodities, and value.

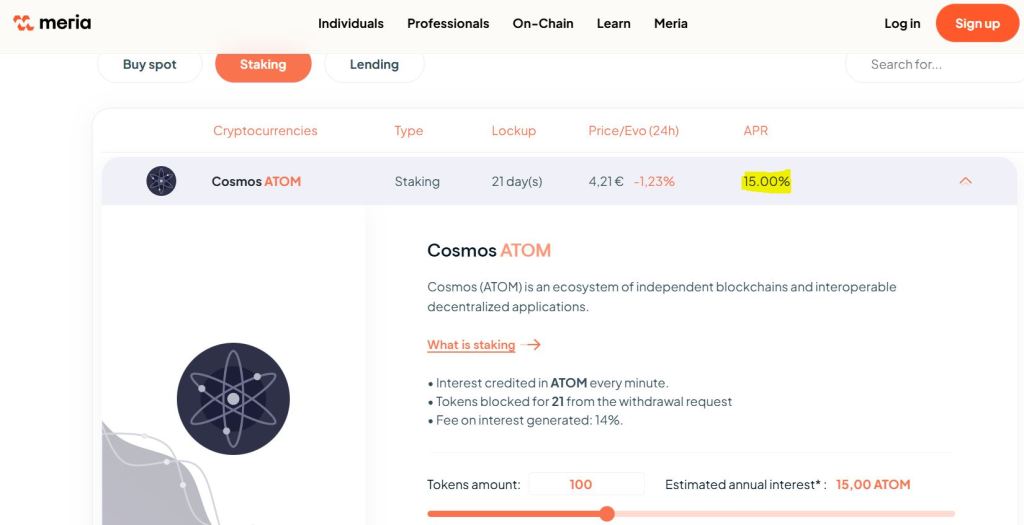

Do you know what staking is ? Staking on the blockchain refers to the process where participants lock up a certain amount of cryptocurrency to support the operations and security of a blockchain network. In return, they earn rewards, typically in the form of additional cryptocurrency. Staking is often associated with proof-of-stake (PoS) or similar consensus mechanisms used by many blockchains.

Partners :

Cardano Use Case : Creation of a custom academic credentialing solution with Identus